Tableau Software (NYSE:DATA)‘s stock had its “hold” rating reiterated by analysts at BMO Capital Markets in a report issued on Friday, February 2nd. They presently have a $92.00 price objective on the software company’s stock. BMO Capital Markets’ price target would suggest a potential upside of 12.52% from the stock’s previous close.

DATA has been the topic of several other reports. Maxim Group reaffirmed a “sell” rating and issued a $40.00 price objective on shares of Tableau Software in a report on Friday, November 3rd. Zacks Investment Researchdowngraded shares of Tableau Software from a “hold” rating to a “sell” rating in a report on Tuesday, January 23rd. Bank of America upped their price objective on shares of Tableau Software from $84.00 to $90.00 and gave the company a “buy” rating in a report on Wednesday, October 18th. Royal Bank of Canada reaffirmed a “sector perform” rating and issued a $75.00 price objective (up from $70.00) on shares of Tableau Software in a report on Wednesday, October 11th. Finally, KeyCorp reaffirmed a “buy” rating and issued a $85.00 price objective on shares of Tableau Software in a report on Friday, October 6th. One equities research analyst has rated the stock with a sell rating, eighteen have issued a hold rating, fourteen have issued a buy rating and one has given a strong buy rating to the company’s stock. The stock has an average rating of “Hold” and a consensus price target of $81.26.

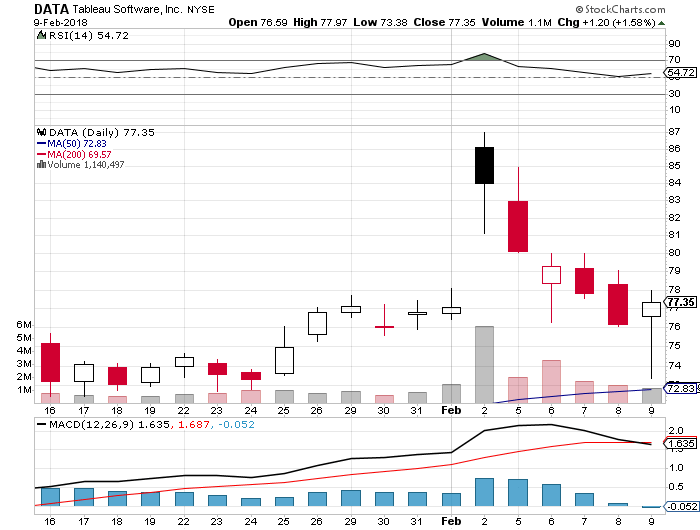

Shares of Tableau Software (NYSE:DATA) opened at $81.76 on Friday. The firm has a market cap of $6,520.00, a P/E ratio of -64.89 and a beta of 0.88. Tableau Software has a 12-month low of $47.30 and a 12-month high of $87.00.

Tableau Software (NYSE:DATA) last released its quarterly earnings data on Thursday, February 1st. The software company reported $0.12 EPS for the quarter, beating the consensus estimate of $0.03 by $0.09. The business had revenue of $249.40 million for the quarter, compared to the consensus estimate of $240.63 million. Tableau Software had a negative net margin of 21.16% and a negative return on equity of 23.76%. The business’s revenue for the quarter was down .5% on a year-over-year basis. During the same period in the prior year, the firm earned $0.26 EPS. analysts anticipate that Tableau Software will post -1.95 earnings per share for the current year.

In other Tableau Software news, insider Andrew Beers sold 20,000 shares of the company’s stock in a transaction on Wednesday, December 6th. The shares were sold at an average price of $70.46, for a total transaction of $1,409,200.00. Following the completion of the transaction, the insider now directly owns 188,422 shares in the company, valued at $13,276,214.12. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, insider Adam Selipsky sold 3,200 shares of the company’s stock in a transaction on Thursday, November 30th. The stock was sold at an average price of $70.06, for a total transaction of $224,192.00. Following the transaction, the insider now owns 200,622 shares of the company’s stock, valued at $14,055,577.32. The disclosure for this sale can be found here. Insiders have sold 959,309 shares of company stock valued at $75,080,924 over the last 90 days. 24.76% of the stock is currently owned by company insiders.

Several hedge funds and other institutional investors have recently modified their holdings of the company. The Manufacturers Life Insurance Company raised its position in shares of Tableau Software by 7.9% in the second quarter. The Manufacturers Life Insurance Company now owns 2,287 shares of the software company’s stock valued at $140,000 after buying an additional 167 shares during the last quarter. State Board of Administration of Florida Retirement System raised its position in shares of Tableau Software by 1.0% in the third quarter. State Board of Administration of Florida Retirement System now owns 77,351 shares of the software company’s stock valued at $5,793,000 after buying an additional 730 shares during the last quarter. Voya Investment Management LLC raised its position in shares of Tableau Software by 4.5% in the second quarter. Voya Investment Management LLC now owns 23,038 shares of the software company’s stock valued at $1,412,000 after buying an additional 983 shares during the last quarter. Archon Capital Management LLC raised its position in shares of Tableau Software by 2.8% in the fourth quarter. Archon Capital Management LLC now owns 37,742 shares of the software company’s stock valued at $2,612,000 after buying an additional 1,020 shares during the last quarter. Finally, State of Wisconsin Investment Board raised its position in shares of Tableau Software by 8.5% in the fourth quarter. State of Wisconsin Investment Board now owns 13,203 shares of the software company’s stock valued at $914,000 after buying an additional 1,031 shares during the last quarter. Institutional investors and hedge funds own 82.24% of the company’s stock.

About Tableau Software

Tableau Software, Inc (Tableau) offers software products. The Company’s products are used by people of diverse skill levels across all kinds of organizations. The Company’s products are used by people of skill levels across all kinds of organizations. Its technologies include visual query language (VizQL) and Hybrid Data Architecture.

Receive News & Ratings for Tableau Software Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Tableau Software and related companies with

[“Source-ledgergazette”]