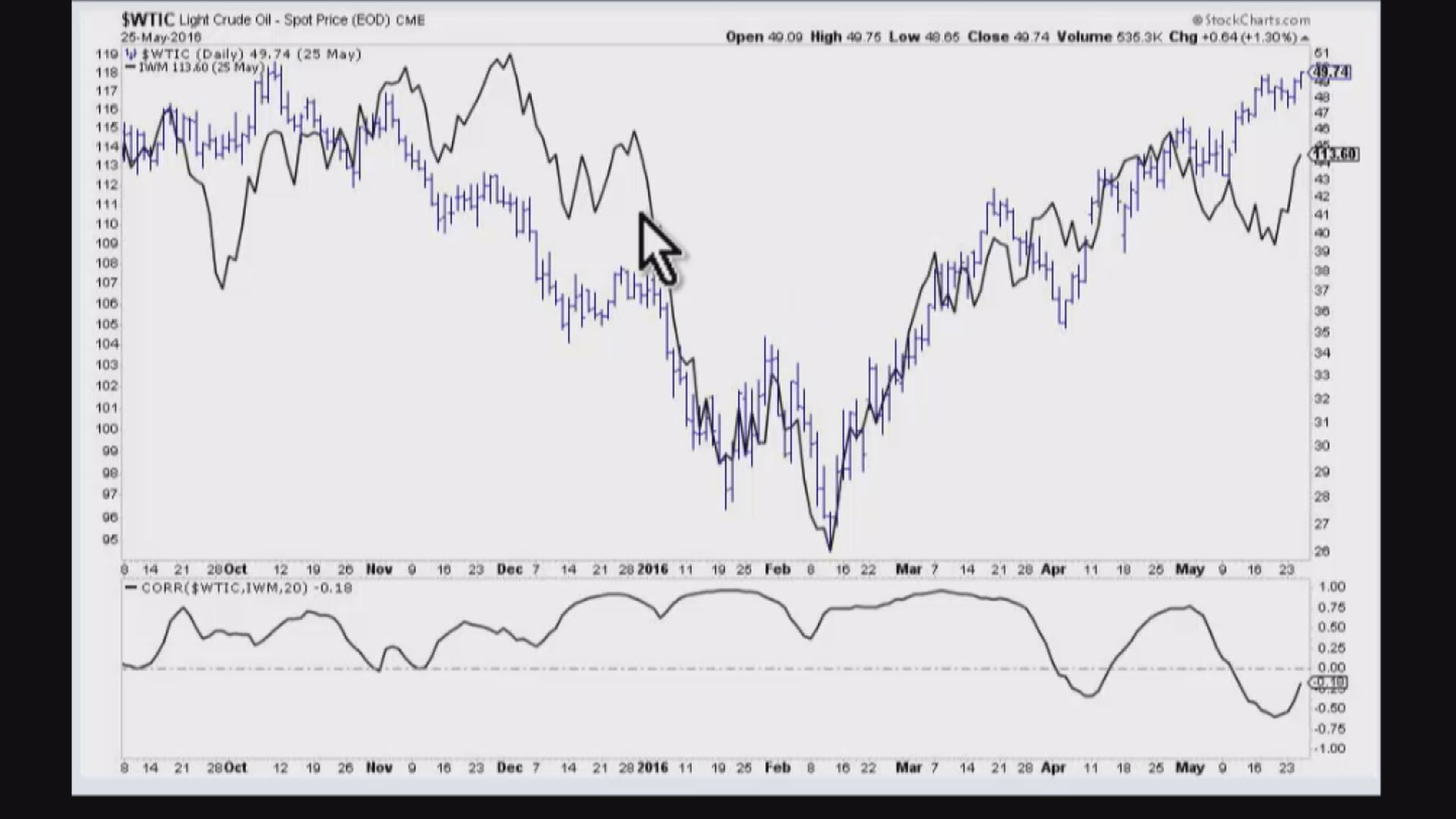

On Thursday, Todd Gordon of TradingAnalysis.com counseled investors about continuing to depend uponthe oil rally to determine market trends.

“you will note that in just the ultimate several months, that correlation has started to transport decrease and in reality moved into the bad territory — meaning the two pass in contrary guidelines,” he stated on CNBC’s “trading kingdom.” “So my factor is you cannot assume rallying crude oil to keep to propel stocks better.”

in keeping with Gordon’s charts, oil and shares have been highly correlated for an amazing period of timethru 2015 and into 2016, and most effective in current months have they started out transferring aside.

but Gordon additionally believes the weakening courting between can truly lead to a smart alternativesplay. without oil’s support, the chart of the Russell 2000 ETF (IWM) surely looks as an alternativesusceptible, he stated. On a quick term chart of the IWM, the technical analyst finds that the ETF has violated a recent uptrend, developing a capability level of resistance.

His plan is to sell a call spread at the IWM. no longer handiest will he get to get hold of cash only formaking the trade, but even supposing small caps emerge as growing a piece, the exchange shouldnevertheless land up being worthwhile.

“you may make money in case you‘re right and the market actions down, [but] we can also make a pieceof money if the market is going sideways and we are able to even make some cash if we pass a touchhigher. So this is a chunk of a hedge as opposed to outright shorting an uptrend,” he stated.

specially, Gordon is selling the 114-strike calls expiring on June 3 and buying the 115-strike calls expiring on the identical day. he’s taking in a credit score of roughly 40 cents for putting at the alternate, or $forty peroptions agreement.

If the IWM remains beneath $114 next Friday, Gordon gets to preserve that complete quantity. His breakeven is at $114.forty, and if the ETF closes at $115 or above, he’s going to become losing $60consistent with contract.