The market simply got ahead of itself on Nvidia, Citron Research’s Andrew Left said on CNBC’s “Fast Money” on Wednesday.

Left argued that the stock, which has gained more than 231 percent in 2016, is simply not worth its current valuation. The stock’s price-to-earnings ratio was recently seen near 57 on a trailing 12-month basis, according to FactSet.

“If you own the stock, the easy money’s been made. Buying it right here, it’s a bit more challenging,” Left said, pointing to the stock’s recent rally. Up to Tuesday’s close, the stock had gained 65 percent since the election.

Some investors are buying Nvidia shares as if the company has been declared the clear winner in the emerging artificial intelligence market, said Left, who is known for his successful shorts against companies like Valeant Pharmaceuticals. Short selling is a form of trading in which traders can bet against a company by selling shares they do not own and buying them back at a lower price.

While Left said he admires the company and thinks it’s “terrific,” he is shorting the stock.

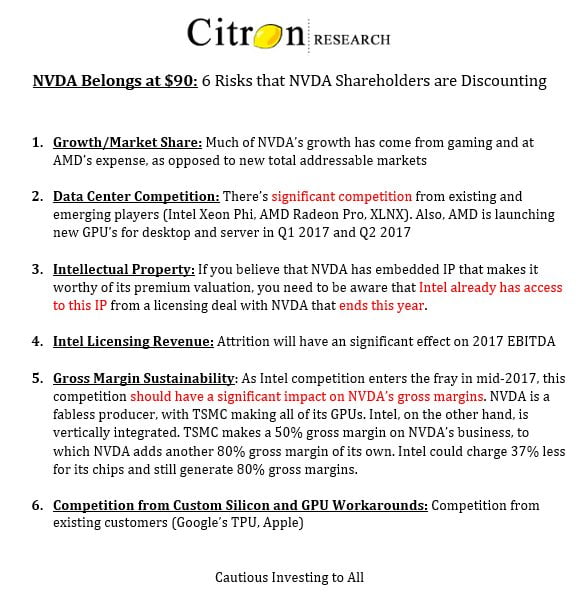

Earlier on Wednesday, Citron published a report that said Nvidia shareholders are discounting “significant competition,” which could “have a significant impact on NVDA’s gross margins.”

Follow

Citron Research @CitronResearch

Citron readers know we have long been fans of $NVDA,but now the mkt is disregarding headwinds. In 2017 we will see $NVDA head back to $90

179179 Retweets

222222 likes

Left told CNBC “there’s still risks to this business going forward,” which is mainly “transferring their revenue from where it is right now, from gaming to more data centers, capturing more of the auto market.”

The short-selling firm said it sees the stock heading back down to $90 a share. That figure is only slightly below the average price target of about $93.37, according to FactSet. The report impacted the stock, which ended the day more than 6 percent lower at $109.25 a share.

Nvidia declined to comment on the report to CNBC.

source”cnbc”