After bringing Samsung Pay to non-premium smartphones in its portfolio, Samsung now has bigger ambitions for its mobile payments platform: ubiquitous presence. The top Android smartphone seller has held internal talks within the company and with OEMs about bringing Samsung Pay to high-end smartphones of other companies, a source familiar with the developments told Gadgets 360.

The emphasis in the talks has been on further extending the reach of Samsung Pay, which for now remains available only on select Samsung smartphones. While several premium Samsung phones support the full-fledged Samsung Pay service, some mid-range phones, such as Galaxy J7 Pro and J7 Max that recently launched in India, only support a stripped down version of the service, called Samsung Pay Mini.

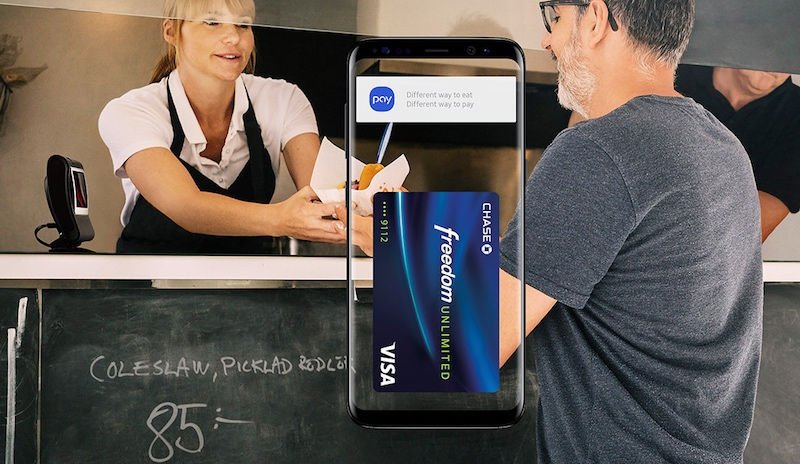

Samsung Pay Mini supports wallet apps and the ability to store and use credit card information, but it doesn’t feature offline tap-and-pay ability seen on full-fledged Samsung Pay service. Tap-and-pay enables customers to use their phone with virtually any card swiping terminal.

Samsung also plans to bring support for full-fledged Pay on its mid-range smartphones, two people familiar with company’s plans told Gadgets 360. Fresh batches of mid-range smartphones featuring special hardware – similar to chips inside Galaxy S8 and select other smartphones – will ship later this year that would make those phones compatible with the full-fledged Samsung Pay service.

In the run up to the launch of Samsung Pay, in 2015, the South Korean conglomerate acquired LoopPay, a Massachusetts-based startup which built proprietary Magnetic Secure Transmission (MST) technology. The same technology is behind the offline tap and pay feature — which mimics a card swipe. Competing services Android Pay and Apple Pay don’t offer a similar functionality, and work only with NFC-enabled terminals.

To enable support for full-fledged Samsung Pay on rival’s smartphones, those companies need to add a specialised chip that enables MST technology on their handsets. For this, the source said, the company has held initial talks with other smartphone vendors in various markets. Samsung did not comment on Gadgets 360’s queries.

In the meanwhile, the company is also exploring whether selling an accessory that bridges the technical barrier for other Android smartphones to support full-fledged Samsung Pay is feasible and in company’s best interest, the source said. The accessory could be similar to LoopPay Card, a battery-powered plastic puck that at present supports only a handful of smartphones.

Either or both of the strategies could be finalised, the source said. The current timeline for either of these developments to hit the market is mid-2018, the person added.

Samsung’s mobile payments service is already at the forefront of OEM-Pay market. According to marketing research firm Juniper, Samsung Pay had about 34 million customers as of earlier this year, second only to Apple Pay, which has over 80 million customers. Android Pay was estimated to have 24 million customers.

Samsung, however, is more aggressively bringing its Pay to other markets, and experimenting with the service to make it more appealing to customers. For instance, the company launched the service in India this year.

Samsung took many by surprise when it said its Pay service in India will support country’s UPI platform and wallet app Paytm, both of which in some way are going after the same customers as its own payment service. The decision to open Samsung Pay to competing platforms gives away the company’s intentions of scaling the service.

Source:-gadgt360