The reason anyone would buy negative-yielding debt is actually pretty simple: Because they have to.

They are central bankers looking to help promote economic growth. They are insurance companies, pension funds and money managers who have to match liabilities with assets. They are not, by and large, retail investors who are so afraid of risk that they’re willing to pay for the privilege of lending money to a government.

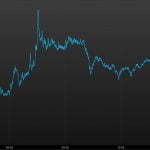

Together, those buyers have helped build a nearly $12 trillion funnel of negative-yielding sovereign debt — unprecedented in world history.

Ostensibly, the global race to the bottom was supposed to stimulate growth, and it may just well keep pushing risk assets higher. But what awaits on the other side is adding to the worries of investing professionals.

“Ultimately, there will be a day of reckoning,” said Erik Weisman, chief economist at MFS Investment Management. “When that will be remains very much to be seen.”

Weisman spoke as the level of negative-yielding global debt was at $11.7 trillion, according to an estimate in late June by Fitch Ratings Service that no doubt would be higher now. Equity markets were in rally mode Monday, with major U.S. stock market averages touching record highs.

Yet there remains a pervasive feeling on Wall Street that the risk rally is built on sand, with a price to pay in a world where owning government debt no longer pays but rather costs.

“There’s no doubt that there are and will continue to be unintended consequences, and the further we move away from something conventional into unconventional, the ratio of unintended consequences to intended consequences will rise,” Weisman said.

In the meantime, the pile of negative-yielding debt likely will grow.

The European Central Bank and the Bank of Japan are committed to ultra-easy policy in hopes that negative rates will push investors even further out on the risk curve. Japan saw an additional boost Monday on news that the government has plans for more aggressive fiscal policy.

“We must be close” to the end of ultra-low rates, said Kathy Jones, chief fixed income strategist at Charles Schwab, which has been predicting declining rates. “Now we’re at a point where the risk-reward is so skewed that you wonder how sustainable it is. I would argue this is not a situation that’s likely to be sustainable over time.”

There was some concern earlier in the year that the Federal Reservealso would pursue negative rates, heightened by the U.S. central bank’s insistence that banks stress test for such a scenario.

However, Fed officials since have dispelled that speculation, acknowledging that it had been discussed but was not under serious consideration. The Fed In October 2014 ended the quantitative easingprogram that had exploded its balance sheet to $4.5 trillion, but has since has kept interest rates anchored low. It approved a quarter-point hike in December but has not moved since then and isn’t expected to do so through 2016.

“It’s hard to imagine the U.S will enter negative-yield territory. Overseas, it’s a different story, particularly in the euro zone,” said Ninh Chung, head of investment strategy at SVB Asset Management. “Typically, lower yields are a temporary stimulus for the consumer, essentially by lowering borrowing costs. We’re in our eighth year post the Great Recession where lower yields really haven’t produced.”

Indeed, under normal circumstances, the low interest rates fostered by central banks around the world would be a catalyst for economic performance. However, recent history has shown that’s no longer true, even now that the world is swimming in negative-yielding debt.

Economic forecasts are getting ratcheted lower instead of higher, and expectations for inflation, a seemingly natural outgrowth of low rates, are falling as well.

“The top five central banks are all projected to deliver negative or close to (zero) real rates on average over the next 10 years,” Shyam Rajan, rates strategist at Bank of America Merrill Lynch, said in a note to clients. “Yet not a single one of these central banks is projected to hit its long-term inflation target.”

Rajam worries that pension funds in particular are nearing capitulation, or the point where they begin to cut risk as negative rates increase worries over stability and as gaps widen in funding levels for retirement plans.

Jones thus believes the most logical road for investors is not to increase risk but rather to exercise a higher level of caution.

“The problem is everyone is reaching to levels where the risk-reward is unattractive,” she said. “Unfortunately that means the best advice we can give is to be cautious — stay short to intermediate term and high credit quality. It’s not exciting.”

[“source-gsmarena”]